The Islamic Republic of Pakistan (Islamic Republic of Pakistan), referred to as "Pakistan", is located in the northwest of the South Asian subcontinent. It borders India in the east, adjoins China in the northeast, shares a border with Afghanistan in the northwest, is adjacent to Iran in the west, and is close to the Arabian Sea in the south.

Pakistan's economy is dominated by agriculture, with agricultural output value accounting for 19% of the gross domestic product. The industrial foundation is weak.

Main Religions: Islam.

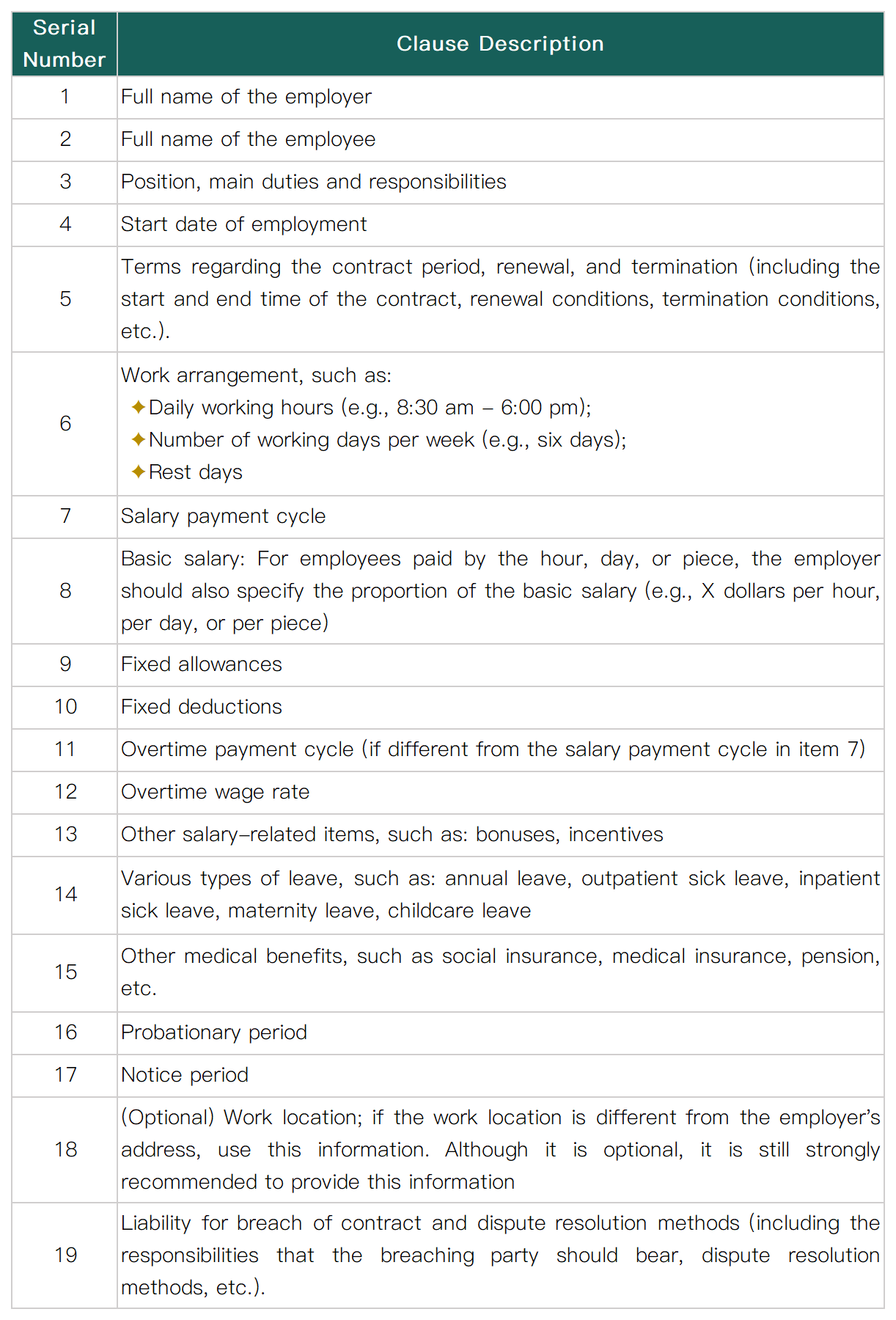

In Pakistan, all enterprises with 20 or more employees must sign a formal employment contract when hiring employees. According to Pakistan's labor regulations, when drafting a "Model Employment Contract", enterprises should include the following 5 to 10 items.

The employment contract can be oral or written. If the contract is in written form, all employers must provide a copy of the written employment contract to the employee. In addition, the employer must obtain the consent of the employee before making any subsequent changes to the terms of the employment contract. Signing a written contract is not mandatory. An oral contract still refers to the act. Therefore, workers are protected.

✦ In Pakistan, the labor law does not clearly stipulate specific terms for the probationary period, but many employers will include relevant terms for the probationary period in the labor contract.

✦ The length and conditions of the probationary period are usually clearly stipulated in the labor contract. The common probationary period is 3 to 6 months.

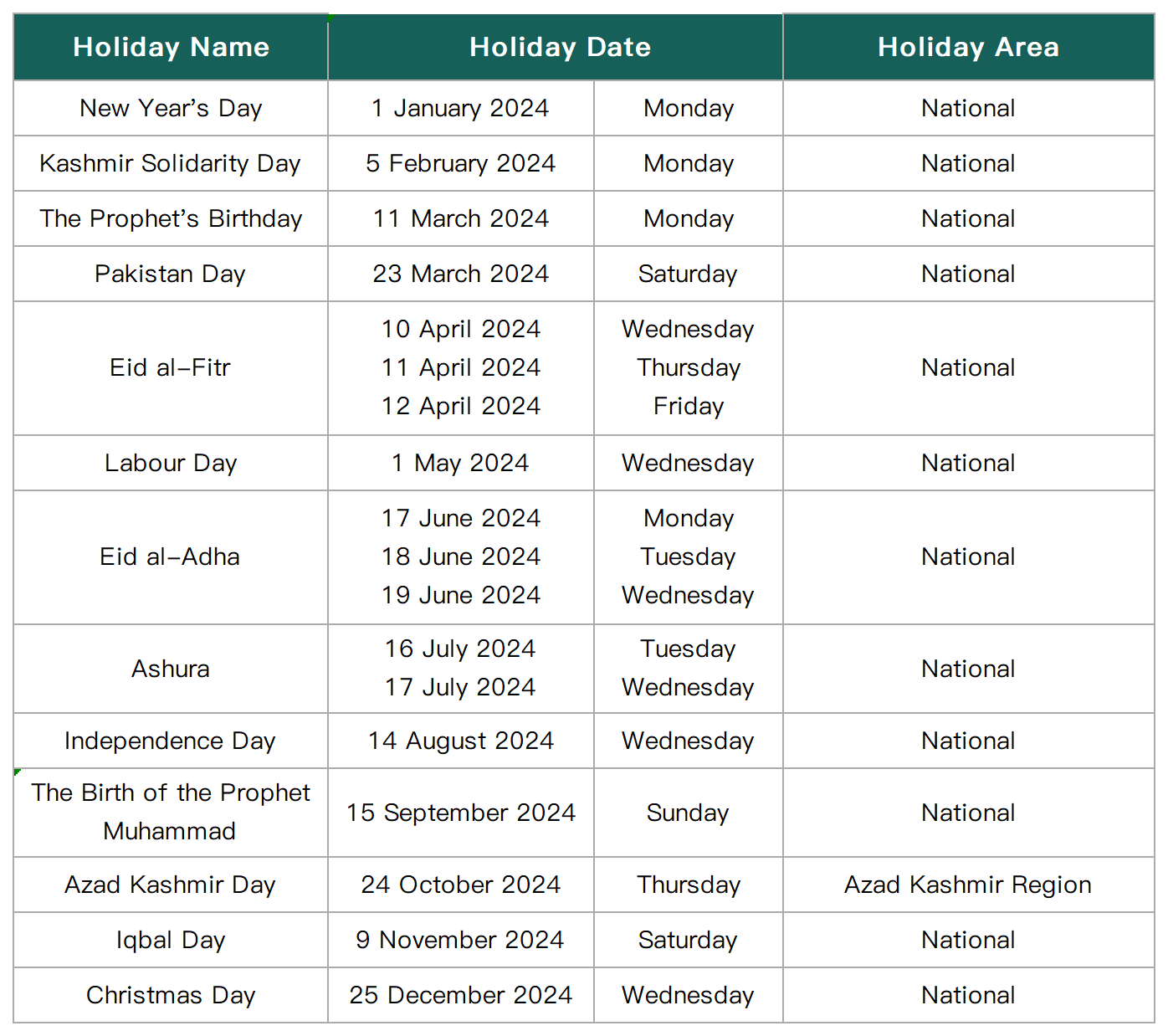

In Pakistan, holidays are generally divided into two types: one is religious festivals, and the other is national holidays stipulated by the government. Public holidays mainly include the following important festivals:

1. Legal Working Age:

✦ Legal working age: According to Pakistan's "Child Labor Prohibition Act", the legal working age is 14. Children under 14 years old are not allowed to engage in any form of work.

✦ Teenage employees: Teenage employees aged 14 to 18 are specially protected when working.

2. Standard Working Hours:

✦ Adult employees: Adult employees (18 years old and above) usually work 48 hours per week, divided into 6 days, 8 hours per day.

✦ Teenage employees: Teenage workers aged 14 to 18 must not work more than 36 hours per week, and the daily working hours must not exceed 6 hours.

✦ Special industries: Certain industries (such as construction, agriculture, etc.) may have different working hour regulations, which are specifically determined by relevant laws or industry standards.

✦ Flexible working hours: Some companies may implement flexible working hours, allowing employees to adjust working hours according to work needs.

✦ Ramadan: During Ramadan, the daily working hours are reduced by 2 to 3 hours. At the same time, if the work is considered to be very arduous, the government labor supervision department can further require a reduction in working hours.

3. Rest Arrangements:

✦ Adult employees: Enjoy at least 30 minutes of meal break time every day. Have at least one day off per week, usually on Friday or Sunday. Employees enjoy paid rest on legal holidays (such as religious festivals and national holidays).

✦ Teenage employees: Also enjoy daily meal break time, but the specific duration may vary according to the employer's arrangement. There is also one day off per week.

4. Night Shift Time:

✦ Adult employees: Night shift is usually defined as working hours between 10 pm and 6 am. Adult employees can work at night, but employers need to ensure the safety and health of night shift work.

✦ Teenage employees: According to the law, teenage workers are not allowed to work between 10 pm and 6 am.

✦ Special regulations: Night shift work usually requires additional safety measures and health safeguards. Employers should ensure the safety and health of employees working at night.

✦ Compensation: Some companies may provide additional salary compensation for night shift employees to reflect the special nature of night shift work.

5. Overtime Hours:

✦ Adult employees: The time that adult employees work outside the legal working hours is overtime and requires additional salary compensation.

✦ Teenage employees: The overtime hours of teenage workers are strictly limited. Generally, overtime is not allowed and must not exceed the legal working hours.

✦ Overtime compensation: Workers should receive additional pay during overtime, usually 1.5 or 2 times the normal wage, depending on company policies and labor contracts.

✦ Overtime pay calculation formula:

Overtime pay = Total monthly salary x 2 (1.5) x Overtime hours

—————————————————————

Working days in a month x 8 (working hours in a day)

1. Annual Leave:

✦ Regulation: Employees can enjoy a certain number of days of annual leave for every year of work, usually 14 days.

✦ Application: Applicable to all full-time employees.

✦ Others: If the annual leave is not used up in the current year, the balance can be carried forward to the next year, with a maximum carry-over of 14 days.

2. Sick Leave:

✦ If hospitalization is not required, employees are entitled to 10 days of sick leave.

✦ If hospitalization is necessary, employees can enjoy up to 30 additional days of sick leave.

✦ In case of long-term illness, employees suffering from mental illness or other diseases requiring long-term treatment, such as tuberculosis, cancer, leukemia, heart disease, polio, leprosy, cerebral thrombosis, etc., can apply for sick leave. With certification from a registered group clinic, they can obtain up to three consecutive months of full-pay sick leave, followed by another three consecutive months of half-pay sick leave, and then another three consecutive months of unpaid sick leave.

✦ After full recovery, employees should resume work on the condition that medical personnel certify that he/she is fit to continue working.

✦ In addition to 14 days of paid annual leave, each employee is entitled to 10 days of full-pay personal leave and another 16 days of half-pay sick leave or medical leave. In some cases, such as sudden illness, personal leave can be enjoyed, but medical certification is required.

3. Hajj Leave:

✦ In Pakistan, the labor law does not clearly stipulate "Hajj Leave" as a legal holiday, but many companies and organizations usually provide relevant holiday arrangements according to the needs and religious beliefs of employees.

✦ Applicable objects: Mainly applicable to Muslim employees, as pilgrimage is an important part of Islamic teachings.

✦ Holiday duration: Usually, Hajj leave can be 30 days or longer, and the specific number of days depends on company policies and the situation of employees.

✦ Application conditions: Employees need to apply to the employer in advance and provide relevant proofs, such as pilgrimage arrangements or registration confirmations.

✦ Remuneration treatment: Whether Hajj leave is paid usually depends on company policies. Some companies may provide paid leave, while others may offer unpaid leave.

✦ Religious importance: Pilgrimage is a religious obligation that every Muslim should perform at least once in a lifetime. Therefore, many employers will try their best to support employees in completing this religious activity.

✦ Company policies: Different companies may have different regulations on Hajj leave. Employees are advised to consult the company handbook or confirm relevant policies with the human resources department when they join the company.

The types of leave stipulated by Pakistan's labor law include annual leave, sick leave, as well as various forms such as maternity leave, paternity leave, holidays, marriage leave, and bereavement leave. The specific number of days of leave and applicable conditions may vary depending on company policies. However, Pakistan's labor law does not specifically stipulate Hajj leave, but many employers will give employees corresponding leave arrangements according to religious beliefs. Employees need to apply in advance and understand company policies to ensure the smooth completion of the pilgrimage.

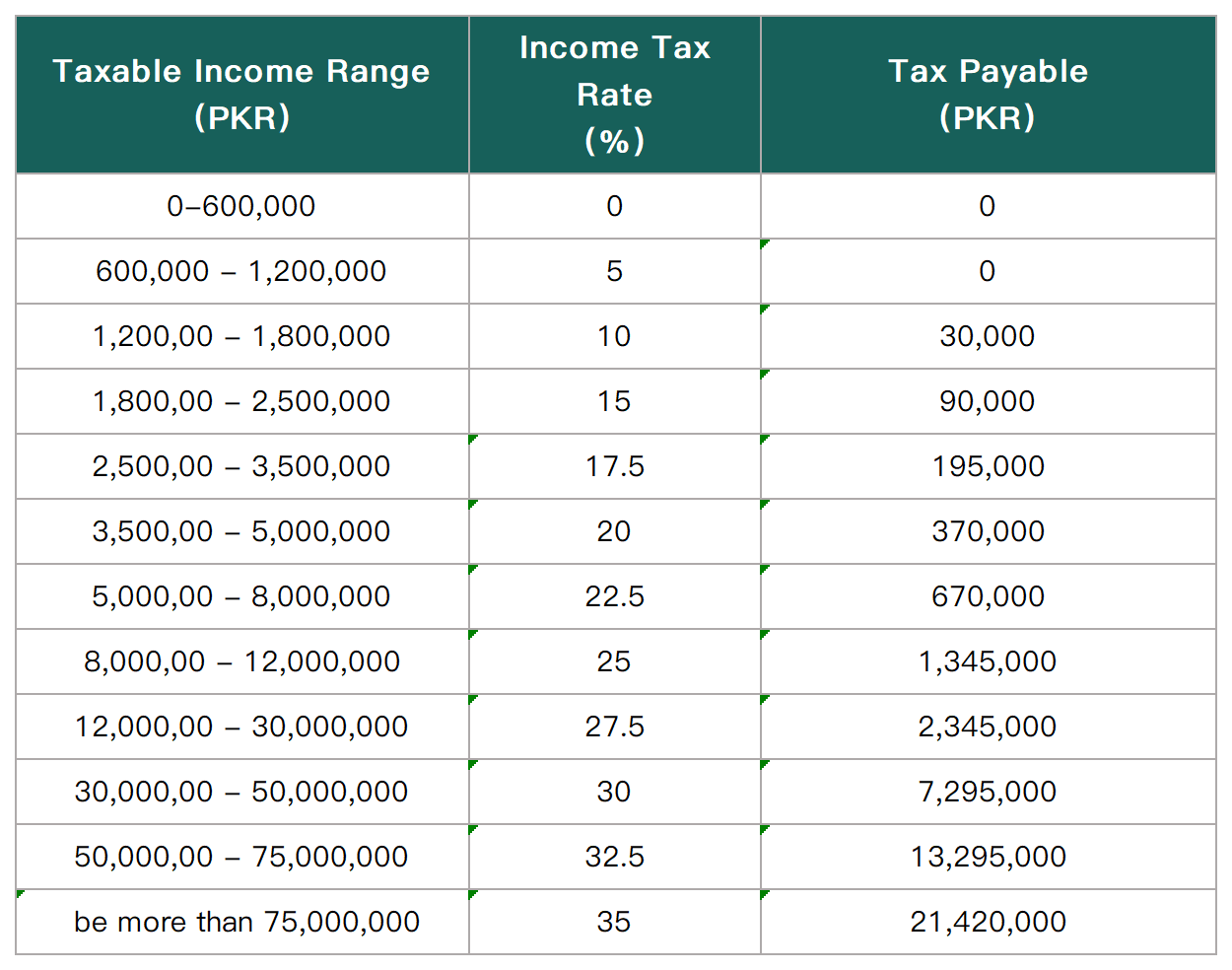

In Pakistan, the personal income tax for employees ranges from 0% to 35%. Income tax is calculated according to a progressive tax rate. For specific details, please refer to the following table:

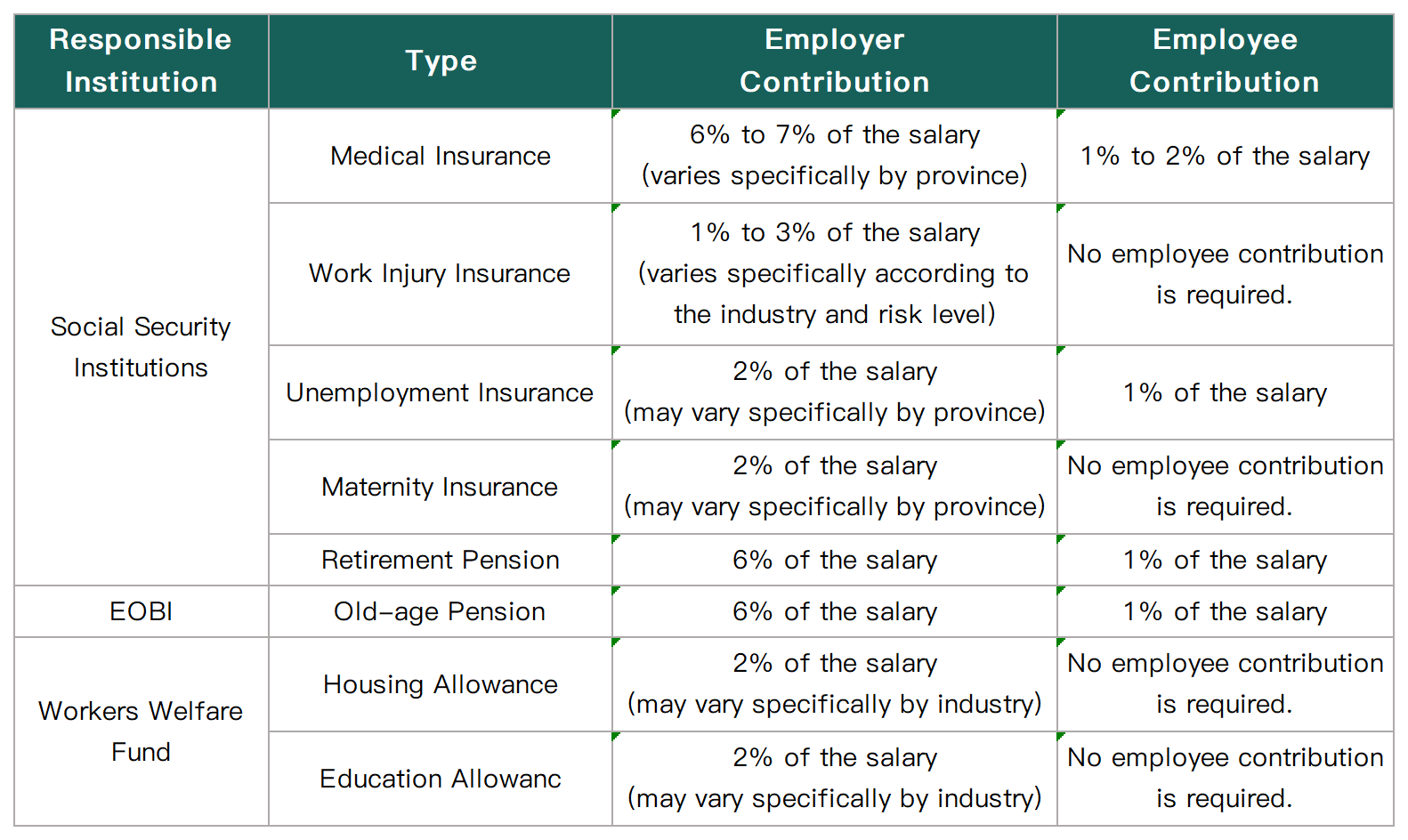

Pakistan's social security system aims to provide employees with basic living security and medical support. Employers and employees jointly bear the responsibility of paying contributions. For detailed information on Pakistan's statutory social security, please refer to the following table:

* These statutory social security institutions together constitute Pakistan's social security system, providing employees with protection in multiple aspects such as medical care, old-age care, and work-related injuries. The specific contribution rates and benefit contents may vary depending on regions and industries.

In Pakistan, in addition to the statutory social security benefits, there are also some non-statutory social security systems. These systems are usually voluntarily provided by enterprises or industry associations, aiming to enhance the welfare and protection of employees. The following are some common non-statutory social security systems:

1. Voluntary welfare plans of enterprises:

✦ Health insurance: Many companies provide employees with additional health insurance that covers a wider range of medical services.

✦ Life insurance: Some enterprises provide life insurance to ensure the economic security of employees and their families.

2. Pension plans:

✦ Corporate pension plans: In addition to the statutory pension, many companies offer additional pension plans to attract and retain talents.

3. Employee stock options:

✦ Stock option plans: Some companies provide stock options to employees to encourage them to participate in company development.

4. Training and development:

✦ Vocational training and development plans: Enterprises usually invest in employees' vocational training to improve their skills and career development.

5. Flexible work arrangements:

✦ Remote work and flexible working hours: Some companies offer flexible work arrangements to improve employees' job satisfaction.

6. Employee welfare fund:

✦ Welfare fund: Some enterprises establish employee welfare funds for employees' emergency medical care, education or other needs.

7. Mental health support:

✦ Mental health services: More and more companies are beginning to pay attention to employees' mental health and provide psychological counseling and support services.

8. Family-friendly policies:

✦ Paid leave and parenting support: Some companies offer additional paid leave or parenting support to help employees balance work and family life.

These non-statutory social security systems usually depend on the size, industry and culture of the enterprise, aiming to improve employees' job satisfaction and loyalty. The specific welfare contents and provision situations may vary from company to company.

1. Contract Termination Notice:

✦ Any termination notice given by the employee or the employer must be in writing, otherwise it will be considered invalid.

2. Notice Period:

✦ For regular employees: Usually one month. The specific time is agreed in the labor contract. If the employee is in the probation period, the notice period may be two weeks. Employers also need to give employees the same notice period.

✦ For temporary and contract employees: Generally, it is stipulated according to the contract terms and may be from a few days to several weeks, depending on the contract.

✦ For part-time employees: Generally, it is shorter and usually a few days, depending on the employer's requirements and contract agreement.

3. Compensation:

✦ For regular employees: Calculated according to the employee's years of service in the company. Generally, compensation equivalent to one month's salary is paid for each year of service. If the employee has worked in the company for less than one year, compensation is usually made according to the actual number of working days.

✦ For temporary and contract employees: Generally, no severance pay is provided unless it is clearly stipulated in the contract.

✦ For part-time employees: Generally, they do not enjoy severance pay unless specifically agreed.

EOR

EOR GREC

GREC VISA

VISA PAYROLL

PAYROLL

Home

Home

Solutions

Solutions

Resources

Resources

Contact

Contact